Trump’s Tariff Tactics: A Closer Look at the “TACO” Trade and Its Implications

In recent days, the discussion about tariffs has taken on a new flavor under President Donald Trump’s administration. The exchange in the Oval Office, where the president was confronted about the so-called “TACO” trade—short for “Trump Always Chickens Out”—has ignited a debate that extends well beyond partisan lines. This opinion editorial examines Trump’s tariff maneuvers, the media’s interpretation of his rhetoric, and the broader impact on trade, domestic investment, and global economic relations.

At the heart of the conversation is a series of tariff policies and adjustments that have both rattled and reassured market participants. Some critics have labeled these moves as unpredictable, while supporters say such shifts have restored balance to what they perceive as an unfair global trade system. In the following sections, we will get into the implications of these policies, discuss the inner workings of trade negotiations, and offer insights into the media’s role in shaping public opinion.

Understanding the “TACO” Trade Phenomenon

The origin of the term “TACO” is a story in itself. Coined by a Financial Times writer to capture the market’s reaction to abrupt tariff decisions, this tagline suggests that while President Trump may threaten aggressive tariffs, he sometimes retreats, prompting an immediate rebound in the markets. Such a phenomenon has been noted, for instance, when he announced a 50% tariff on European Union goods, then delayed its implementation after consultations with EU leaders.

It is important to note that this exchange was not just a random quip—it was a pointed commentary on an approach to negotiations that many regard as unconventional. The president’s retort to a reporter, dismissing the framing of his actions as “chickening out,” provides an example of how high-stakes policy decisions are interwoven with media narratives. Many have argued that the “TACO” term simplifies a set of tricky parts in the tariff strategy that deserve broader scrutiny.

Let’s break down some key observations about the “TACO” trade:

- Market Sensitivity: Stock reactions to tariff announcements have been brisk, underlining the sensitivity inherent in global trading systems.

- Policy Reversals: The reversal of tariff threats has led to immediate bullish trends, reflecting both the uncertainty and the relief felt by investors.

- Political Messaging: The president’s choice of words and the response to critical questions illustrate how political communication can shape market perceptions.

This set of observations underscores the complexity of U.S. tariff policy, where each move on the global stage is scrutinized not only from an economic standpoint but also as a piece of a larger political puzzle.

Assessing the Trade Negotiation Process and Economic Impact

Trump’s tariff policies are part of a broader strategy aimed at rectifying what many see as an inequitable trading system. Critics argue that his aggressive approach introduces a series of complicated pieces to an already tangled international dialogue on trade. Yet, proponents contend that this strategy is a key—if unconventional—step toward leveling the playing field between domestic industries and foreign competitors.

To fully grasp the impact of these policies, it is necessary to get into the finer details of the trade negotiation process. The following table provides an overview of the tariff adjustments and their immediate effects on different sectors:

| Tariff Announcement | Immediate Market Reaction | Policy Reversal/Delay Impact |

|---|---|---|

| 50% tariff on EU goods | Market dip, investor nervousness | Swift recovery after negotiation extension |

| Initial tariff threat on certain imports | Mixed reactions across sectors | Uncertainty leading to fluctuating investments |

| Tariff pause for negotiation with trade partners | Stabilization in stock indices | Improved negotiations and tempered policies |

These examples demonstrate that while high tariffs might initially produce a nerve-racking shock for the markets, the subsequent policy adjustments can quickly dissipate fears. To be sure, the twists and turns in the tariff saga introduce both opportunities and risks, making it a delicate balancing act for policymakers and market watchers alike.

Media Narratives and the Political Discourse

The media plays a super important role in framing the narrative around Trump’s tariff decisions. During a recent White House event—the swearing-in of an interim U.S. attorney—President Trump was confronted with a question directly linking his tariff decisions to a supposed pattern of backing down. His spirited response, calling the query “nasty” and dismissing the characterization, is emblematic of the emotionally charged atmosphere often accompanying discussions of trade policy.

There are several layers to consider when evaluating media reporting on such issues:

- Choice of Language: The use of colloquial terms like “chicken out” by critics, and the subsequent retort by Trump, are more indicative of a broader media tactic designed to create memorable sound bites rather than to provide a deep dive into the underlying policy complexities.

- Selective Coverage: Often, the media focus on polarizing elements of political rhetoric rather than the stubborn details of negotiation. This selective attention can magnify perceptions of unpredictability and undermine the recognition of policy adjustments that take place behind the scenes.

- Public Perception: The manner in which these exchanges are reported influences public opinion. A narrative that emphasizes shock and controversy may obscure the actual policy decisions that affect the economy and domestic markets.

Journalistic responsibility in covering such politically charged topics requires balancing sensational remarks with a sober analysis of the actual decisions made. There should be room to gesture beyond the surface, to dig into the little details that form the backbone of any economic policy discussion—especially when those decisions are tethered to questions of national interest.

The Domestic Investment Perspective Amid Tariff Uncertainty

Beyond the immediate fracas of political barbs and media impressions, Trump’s tariff policies have had a tangible impact on domestic investment trends. As noted during the Oval Office event, the president mentioned that there were $14 trillion invested, or committed to investing, by the country. This figure is meant to counterbalance the perceived uncertainty from tariff announcements. In reality, the market reactions have been mixed and have contributed to an ongoing dialogue about the future of the American economy.

From an investment viewpoint, several factors come into play:

- Investor Sentiment: Every time a tariff threat is announced, there is a rush to reallocate funds, often leading to a temporary market dip. This is a clear indication that market participants are very sensitive to sudden changes—a signal that should prompt policymakers to consider stability more than spectacle.

- Risk Management Strategies: Traders and institutional investors have increasingly chased opportunities by “buying the dip” following tariff announcements. Although this may benefit short-term profiles, it also underlines the need for more predictable and well-communicated trade strategies.

- Long-term Growth vs. Short-term Wins: Analysts argue that while aggressive tariff moves might spark immediate market reactions, they can also deter long-term investment if businesses see these policies as overly volatile. A consistent message about trade policy is essential to keep domestic and foreign investors confident in long-term prospects.

Innovation, job creation, and economic growth depend on a clear understanding of policy direction. When tariffs become a bargaining chip in international negotiations, domestic economies can be caught off guard by the fine points and unexpected reversals, a situation that is both intimidating and off-putting to potential investors.

International Trade Relations: The Global Impact of Tariff Strategies

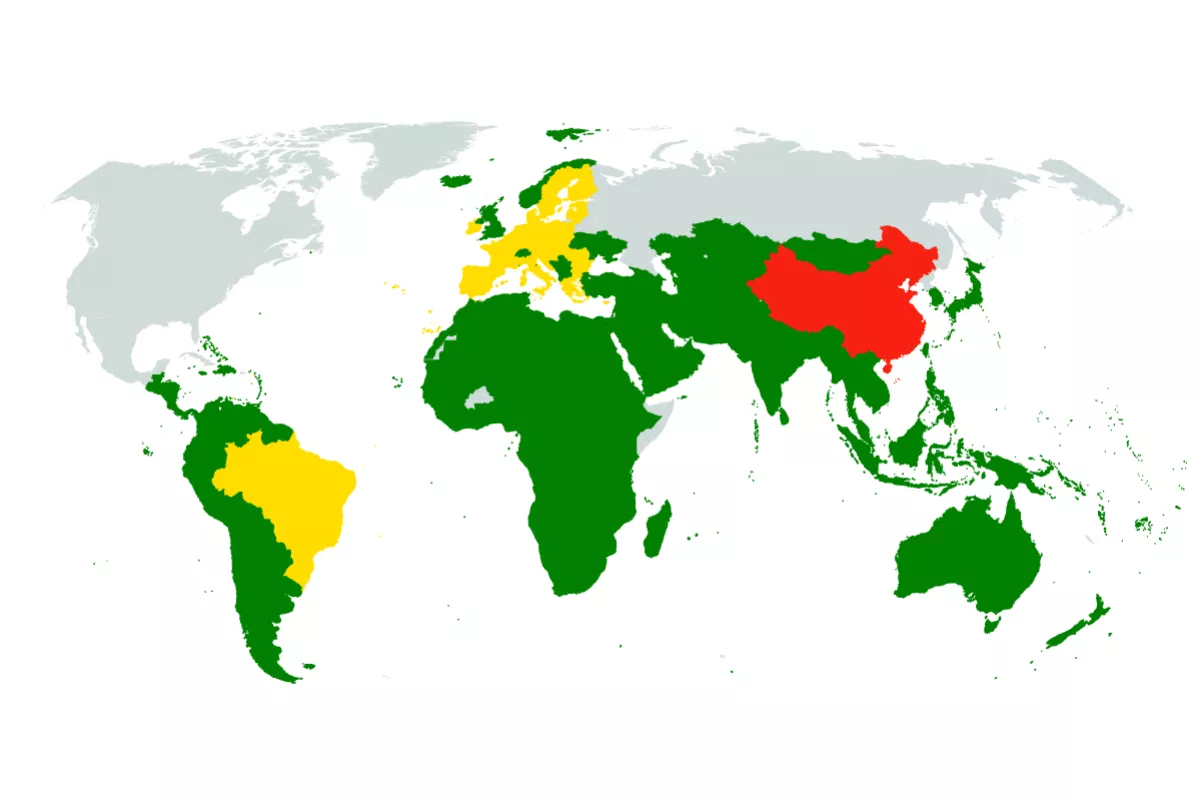

Trump’s tariff policies also cast a long shadow on global trade relations. The administration’s hardline stance—embodied in measures such as the 145% initial tariff on goods from China—has reverberated throughout the international economic community. While some see these measures as an effort to reclaim a level playing field, others view them as provocative actions that complicate global trade dynamics.

Here are several points to consider about the international perspective:

- Diplomatic Negotiations: Tariff adjustments are a double-edged sword. On one hand, they serve as a means to push for favorable trade deals. On the other hand, they can lead to diplomatic friction and a tit-for-tat escalation that may harm long-standing relationships with key allies.

- Economic Stability in Partner Nations: Countries on the receiving end of sudden tariff decisions are forced to reconfigure their trade arrangements. For example, the European Union has had to weigh the costs of complying with U.S. tariffs against the benefits of potential concessions. The constant back-and-forth creates an environment where long-term planning is a challenge.

- Global Market Volatility: Markets around the world react not only to domestic policies in the United States but also to the signaling these actions send. A disruption in one major economy can lead to a cascade of adjustments worldwide, affecting international trade flows and investment decisions.

The twisting and turning of policies like these illustrate that while protectionist measures might temporarily bolster domestic markets, they also risk triggering a broader chain reaction—one that could rouse global economic instability if not managed with careful attention to the fine shades of international diplomacy.

Political Rhetoric and Its Influence on Public Debate

In the current political climate, every statement made by a public official is scrutinized not only for its policy content but also as a signal of broader intentions. President Trump’s dismissive reaction to what he labeled a “nasty” question is emblematic of a deeper divide between political rhetoric and the practical realities of trade negotiations.

Several aspects of this interplay deserve a closer look:

- The Language of Confrontation: Labeling a question as “nasty” is more than just a verbal flourish—it is a strategic response intended to disarm criticism. Such expressions contribute to a narrative that frames political debate as a battleground of strong personalities, rather than as a detailed platform for policy analysis.

- Divisive vs. Unifying Messaging: While confrontational language can energize a political base, it simultaneously alienates those who might otherwise support a more constructive dialogue. In an era where media channels are numerous and varied, it is important for political leaders to find a balance between assertiveness and inclusivity.

- The Role of the Press: Critics argue that the media’s repetition of emotionally charged terms—such as “TACO”—only adds to the tension. Reporters must balance the need for engaging commentary with the responsibility to report on the real, often tangled issues behind economic and political decisions.

This blend of political rhetoric and media portrayal has contributed to a polarized atmosphere, one in which the substance of trade policy is often sidelined by the drama of public exchanges. For the sake of healthy democratic debate, it is essential to look past the hyperbole and focus on the tangible effects of policies on national and international scales.

Coping with Tariff Uncertainty: The Reality for Businesses and Consumers

For everyday businesses and consumers, the constant ebb and flow of tariff announcements is more than just political banter—it has real-world consequences. Uncertainty in trade policy can lead to disruptions in supply chains, price fluctuations, and a range of tricky parts that require strategic adjustments. Whether it is a manufacturer dealing with increased import costs or a retailer facing shifting consumer demand, the effects of tariff policies ripple across the economy.

Let’s consider some of the tangible impacts:

- Supply Chain Adjustments: When tariffs are announced and then unexpectedly revised, companies must quickly adjust their supply chains. This may include sourcing materials from different countries or re-evaluating their production schedules, leading to additional costs and logistical challenges.

- Price Volatility: Tariff announcements can cause prices on imported goods to surge. Although market corrections may follow, the short-term impact can strain household budgets and affect industries such as retail and manufacturing.

- Business Planning and Investment: Firms in sectors heavily reliant on international trade find themselves having to figure a path through a maze of shifting policies. Uncertainty makes long-term planning nerve-racking, as companies struggle to gauge the potential benefits or drawbacks of entering new markets or scaling operations.

For consumers, these disruptions can manifest in higher prices for everyday products or limited availability of certain goods. Even though policy reversals might eventually stabilize the situation, the initial turbulent periods are often full of problems that create a sense of insecurity about the future. Businesses and consumers alike would benefit from a more stable and clearly communicated trade policy regime that prioritizes long-term economic growth over moment-to-moment market maneuvers.

Reflecting on a Shifting Economic Landscape

The current episode, featuring Trump’s response to the “TACO” question, is a snapshot of a larger, evolving story about America’s role in global trade. The president’s approach—marked by rapid policy shifts and a combative engagement with the media—illustrates a broader trend in contemporary politics where traditional negotiation strategies are being upended by dramatic rhetoric and unconventional tactics.

It is worth reflecting on several key observations as the nation moves forward:

- Unpredictability as a Policy Tool: The use of sudden tariff announcements followed by rapid reversals can be seen as a double-edged sword. While it allows for flexibility in negotiations, it also introduces elements of uncertainty that can unsettle both domestic investors and international partners.

- Economic Signal or Political Posturing? Many critics argue that the “TACO” narrative is less about sound economic strategy and more about political posturing. This tension between political optics and actual economic planning creates an environment in which every word and gesture is scrutinized beyond its immediate context.

- The Need for Clear Communication: Both policymakers and media figures have a responsibility to clearly explain the motivations behind policy decisions. This includes admitting the presence of tangled issues and addressing the small distinctions that can make all the difference in understanding policy outcomes.

The economic landscape is continuously changing, and in this era of rapid policy adjustments, it is essential for leaders to ensure that stakeholders can get around the confusing bits and focus on long-term goals rather than short-term theatrics. By offering clear, consistent messages, the government could help both the market and individual investors cope better with the twists and turns of economic policy.

Charting a Course for Future Trade Policies

Looking ahead, it is super important for policymakers to re-evaluate the current tariff framework and consider strategies that reduce uncertainty while still promoting America’s economic interests. A balanced approach might involve setting more predictable guidelines for tariff adjustments, offering businesses a clear roadmap that they can manage their way through without the constant fear of disruptive policy twists.

Some measures that could be taken include:

- Enhanced Dialogue with Trade Partners: Establishing consistent channels of communication would help to smooth over rough patches in negotiations. A policy of transparent negotiation could mitigate the risk of sudden policy changes that are full of problems for global markets.

- Structured Tariff Reviews: Instead of seemingly spontaneous policy shifts, tariffs could be subject to regularly scheduled reviews that allow both domestic and international stakeholders to prepare and adjust.

- Improved Investor Guidance: Clear, concise guidance on how tariff policies will affect specific sectors would benefit businesses and investors alike. Informative sessions, detailed FAQs, and better forecasting could all help in reducing the intimidating nature of current tariff policies.

Implementing such changes would require careful planning and a willingness to address the fine points of economic policy in a straightforward, no-nonsense tone. It is not enough to react to market pressures in a dramatic way; there must be a strategic, long-term vision that embraces both domestic growth and sound international partnerships.

The Broader Political and Economic Implications

Every policy decision, especially in the realm of trade, carries multiple layers of impact. On one level, Trump’s tariff strategies are a reflection of his broader political narrative—a narrative that champions a bold, unyielding approach to negotiations. On another level, these decisions have concrete effects on everything from the stock market to small business investments and consumer buying patterns.

In today’s interconnected world, the policies of one nation can ripple around the globe. While the “TACO” commentary may sound like a humorous jab, the underlying implications are far from trivial. The following bullet points summarize the key takeaways:

- Global Repercussions: Tariff changes reverberate beyond national borders, affecting supply chains and economic stability in multiple regions.

- Investor Caution: The market’s reaction to tariff threats underscores a need for policies that inspire confidence rather than fear.

- Policy Consistency: Frequent shifts generate an environment where long-term planning becomes almost nerve-racking for businesses reliant on stable market conditions.

- Media’s Role: The media continues to play a critical role in magnifying or mellowing the perception of these policies. Responsible reporting can help clarify the small distinctions between political rhetoric and actionable policy.

When viewed through this lens, it becomes clear that trade policies are not just economic instruments—they are tools of political expression that have measurable outcomes on both domestic well-being and international relations. The government’s challenge is to balance these roles with a level-headed approach that minimizes the confusing bits and complicated pieces inherent in any aggressive policy shift.

Weighing the Benefits Against the Risks

For supporters of the current approach, the aggressive tariff measures are seen as a necessary step in correcting trade imbalances and reviving American industry. Yet, for many observers, these same measures introduce risks that may ultimately be counterproductive. The immediate response from markets and the subsequent policy reversals suggest that while short-term gains are possible, long-term stability may remain elusive if clarity and consistency are not prioritized.

An effective way to assess these considerations is to compare the benefits and risks in a simple, organized format:

| Benefits | Risks |

|---|---|

|

|

The table above encapsulates the core dilemmas faced by policymakers. While the push to rebalance trade and support domestic manufacturing is a super important goal, it cannot come at the cost of long-term market stability. In this context, every policy decision becomes riddled with tension, revealing a subtle interplay between immediate national interests and the broader framework of international economics.

Toward a More Predictable Economic Future

A critical assessment of the recent tariff decisions, including the infamous “TACO” label, invites us to reconsider what defines smart economic policy. Rather than relying on reactive tactics that create more problems than they solve, there is a clear need for a measured, well-communicated approach that looks past political theatrics to address the core economic issues at hand.

Achieving such a balance requires:

- Consistency in Policy Implementation: Avoiding sudden and dramatic policy reversals helps to build trust with both domestic and international stakeholders.

- Constructive Dialogue: Engaging with critics, industry experts, and trade partners in a transparent and respectful manner allows for a more detailed discussion on what works and what does not.

- Long-Term Strategic Planning: Instead of aiming for short-term political victories, policymakers should focus on laying the groundwork for sustained economic growth.

This focus on consistency and clarity might help to tone down the high drama of the current tariff debates, replacing headline-grabbing controversies with thoughtful, action-oriented discussions about the country’s economic future. After all, while political catchphrases may capture attention, they seldom offer the fine shades of explanation needed to solve real-world problems.

Concluding Thoughts: Steering Through the Turbulence

In conclusion, the story of the “TACO” trade and the associated media friction encapsulates a broader challenge in modern governance: the need to balance dynamic, even aggressive, policy actions with a steady hand that reassures investors, partners, and the general public. President Trump’s tariff maneuvers have sparked a debate that covers everything from domestic investment strategies to international trade negotiations, proving that the effects of such policies are as tangled as they are far-reaching.

For many, the current approach is a reflection of a desire to correct what is seen as an unfair global trade system. For others, it serves as a cautionary tale: a reminder that every policy decision carries hidden complexities and that the fine points of negotiation cannot be reduced to catchy sound bites alone.

The road ahead is loaded with issues, and stakeholders of all stripes—from political leaders to small business owners—must work together to figure a path that mitigates risk while capitalizing on the benefits of a reformed trade system. As policymakers sift through public sentiment and market realities, a key takeaway should be the importance of crafting trade policies that are consistent, well-communicated, and grounded in long-term strategic planning.

In these nerve-racking times, when every announcement can send shockwaves through global markets, the responsibility lies with our leaders to steer through the confusing bits and intricate twists with a sense of purpose and clarity. Only then can we hope to achieve an economic landscape where policies are not just flashpoints for controversy, but building blocks for a robust and stable future.

Ultimately, while the “TACO” debate may continue to be a shorthand for the volatile mix of political posturing and market manipulation, it also presents an opportunity. It is a chance for policymakers and the public alike to take a closer look at what is truly at stake when trade policy is used as a lever for political gain. As we move forward, let us strive for a dialog that values consistent, clear economic strategies over sensational rhetoric, ensuring that the policies we adopt today build a stronger foundation for tomorrow.

Originally Post From https://www.fox10phoenix.com/news/trump-taco-tariff-question

Read more about this topic at

Trump trade strategy roiled by court blocking global tariffs

Saying Trump exceeded his authority, 12 states ask court ...

0 Comments:

Post a Comment